Issue 4 | H2 2024 Newsletter

With Donald Trump re-elected as President, the financial regulatory landscape in the U.S. is expected to shift towards a more business-friendly approach, focusing on deregulation and reducing compliance burdens. However, financial institutions in NYC are preparing for potential fluctuations in regulatory oversight, as the administration may prioritise specific areas like financial crime, capital markets, and digital assets.

Given the Trump administration’s historically mixed stance on financial regulation – balancing deregulation with selective enforcement – banks and financial services firms are fortifying their compliance frameworks to adapt to changes. This includes focusing on areas where enforcement may intensify, such as anti-money laundering (AML) compliance, sanctions monitoring, and data privacy, especially in response to geopolitical tensions.

To navigate these evolving regulatory challenges, firms are adopting advanced regulatory technology (RegTech) solutions for real-time compliance monitoring, enhancing automated reporting, and bolstering risk management capabilities. The emphasis is on agile compliance strategies to quickly adapt to shifts in policy, particularly around capital requirements, stress testing protocols, and consumer protection laws.

Enhanced Regulatory Compliance and Oversight Under Trump Administration

- Regulatory Change Management and Compliance Transformation: Financial institutions have been actively recruiting professionals skilled in adapting to regulatory changes, particularly those with expertise in the Dodd-Frank rollback provisions, amendments to the Volcker Rule, and shifts in the enforcement of the Bank Secrecy Act. Specialists are needed to lead compliance transformation projects, ensuring firms remain resilient against both deregulation and targeted regulatory enforcement.

- Financial Crime and Sanctions Experts: Despite a general trend towards deregulation, the Trump administration has historically shown a strong stance on sanctions enforcement, particularly in the areas of international trade and foreign policy. This has led to increased demand for AML and sanctions compliance professionals, focusing on AI-driven solutions for enhanced due diligence, transaction monitoring, and sanctions screening in line with FinCEN and OFAC guidelines.

- Regulatory Reporting and Data Governance Specialists: As firms brace for potential regulatory adjustments under Trump’s leadership, there is a growing emphasis on ensuring data accuracy, transparency, and regulatory reporting compliance. Organisations are looking to hire experts skilled in FR Y-14, CCAR, and Basel III/IV reporting, as well as those capable of implementing robust data governance frameworks to meet BCBS 239 compliance standards.

Evolving Cybersecurity and Data Privacy

There is now an expected shift towards a less stringent regulatory approach in some sectors; however, cybersecurity remains a critical focus due to rising geopolitical tensions and increased cyber threats. The administration is likely to prioritise national security, pushing financial institutions to bolster their cyber defenses against potential state-sponsored attacks. Financial services firms in NYC are enhancing their cybersecurity frameworks, driven by both regulatory expectations and the need for resilience against sophisticated cyber threats.

Given the administration’s emphasis on national security, financial institutions are investing heavily in real-time threat detection, incident response, and enhanced data privacy measures, especially with potential updates to the NYDFS Cybersecurity Regulation. This renewed focus is driving demand for cybersecurity talent skilled in safeguarding sensitive financial data and mitigating operational risks.

Key Hiring Focus:

- Cybersecurity Specialists and Incident Response Teams: Firms are prioritising hires with expertise in advanced cyber threat intelligence, incident response, and regulatory compliance, particularly focusing on safeguarding critical infrastructure and financial systems against ransomware and phishing attacks.

- Data Privacy and Compliance Officers: As data privacy concerns grow, there is an increased focus on hiring professionals to manage compliance with data protection regulations, including cross-border data transfer protocols and third-party risk management in line with evolving federal and state privacy laws.

Renewed Emphasis on Conduct and Culture Risk

There is likely to be be a recalibration of regulatory focus towards conduct and culture risk, particularly in response to high-profile corporate scandals and misconduct cases. Financial institutions are reinforcing their internal conduct frameworks to ensure compliance with existing regulations while preparing for potential changes in enforcement priorities.

The emphasis on restoring public trust and maintaining ethical standards means firms are investing in programs that enhance governance, improve internal controls, and promote a culture of compliance. This includes leveraging data analytics to monitor conduct risk and enhance transparency in governance practices.

Key Hiring Focus:

- Conduct Risk and Compliance Officers: Demand for specialists who can lead conduct risk assessments, implement ethical training programs, and enhance monitoring frameworks is on the rise. Financial services firms are also looking to expand their teams focused on trader surveillance and employee behavior analytics to mitigate conduct risk.

- Governance and Ethics Consultants: There is a growing need for experts who can advise on corporate governance best practices, ensuring firms remain compliant with regulatory standards while fostering a culture of accountability.

Model Risk Management (MRM) in a Deregulated Environment

While the Republican’s may push for reduced regulatory burdens, model risk management remains a critical focus area, especially for firms using AI/ML models in trading and risk assessment. The Federal Reserve’s SR 11-7 guidance on model risk governance is likely to stay in place, prompting banks to continue strengthening their model validation frameworks, particularly around algorithmic trading, credit risk modeling, and stress testing.

As financial institutions increase their reliance on data-driven models, there is a heightened focus on ensuring models’ transparency, robustness, and compliance with regulatory expectations, even in a more relaxed regulatory environment.

Key Hiring Focus:

- Model Validation Experts and Quants: Firms are actively recruiting professionals with expertise in validating complex financial models, including AI and machine learning models, to ensure compliance with both existing and emerging regulatory guidelines. The focus is on reducing model risk while optimising model performance.

- Algorithmic Trading Control Specialists: There is a high demand for professionals skilled in designing and overseeing algorithmic trading controls, ensuring compliance with risk management standards and mitigating the potential for market abuse or systemic risk.

Strategic Regulatory Advisory and Horizon Scanning Post-Election

Financial institutions are anticipating shifts in regulatory priorities, prompting a renewed focus on strategic regulatory advisory and horizon scanning. Firms are enhancing their capabilities to proactively address changes in regulations affecting areas like capital markets, consumer protection, and digital assets.

The result of this 2024 U.S. election will significantly shape the GRC landscape in NYC, driving demand for talent skilled in regulatory change management, cybersecurity, data privacy, and ESG compliance. Financial institutions are preparing for potential shifts in regulatory priorities, making strategic hires to strengthen their compliance, risk management, and governance frameworks. As firms navigate this period of uncertainty, the focus will be on building resilience and adaptability to thrive in a dynamic regulatory environment.

The potential deregulation in certain areas, coupled with stricter enforcement in others, is driving the need for experts who can provide strategic guidance on navigating this complex landscape. Financial services firms are investing in technology to streamline compliance processes, reduce regulatory costs, and maintain agility in responding to policy changes.

Key Hiring Focus:

- Regulatory Strategy Advisors: Professionals skilled in interpreting policy shifts and assessing their impact on business strategy are in high demand. Firms are seeking experts who can provide forward-looking insights into potential regulatory changes, particularly around the Dodd-Frank Act modifications, Basel IV implementation, and evolving digital asset regulations.

- GRC Technology Implementation Specialists: As firms leverage RegTech to enhance compliance efficiency, there is a growing need for professionals who can implement automated solutions for regulatory reporting, risk management, and compliance monitoring, ensuring alignment with both current and anticipated regulatory requirements.

Summary

The result of this 2024 U.S. election will significantly shape the GRC landscape in NYC, driving demand for talent skilled in regulatory change management, cybersecurity, data privacy, and ESG compliance. Financial institutions are preparing for potential shifts in regulatory priorities, making strategic hires to strengthen their compliance, risk management, and governance frameworks. As firms navigate this period of uncertainty, the focus will be on building resilience and adaptability to thrive in a dynamic regulatory environment.

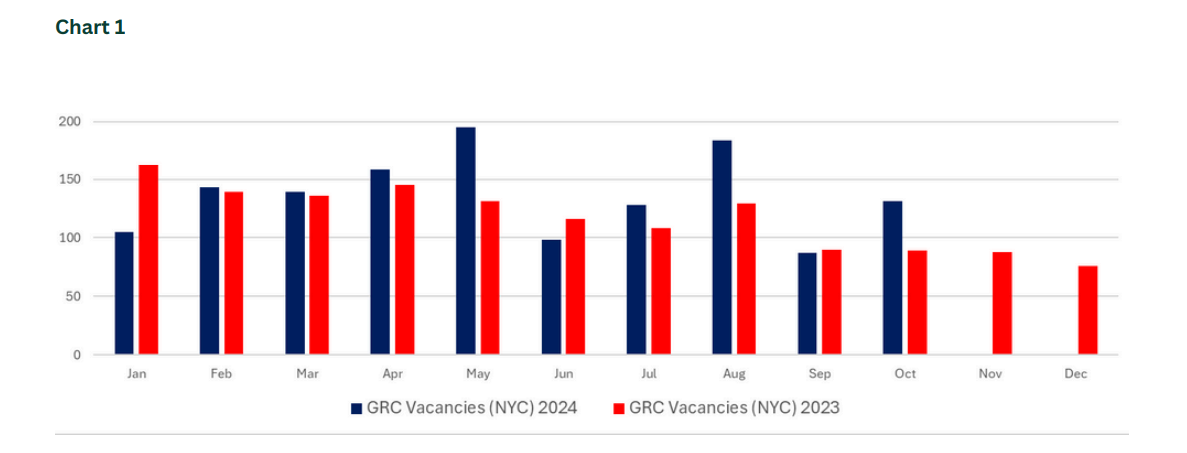

Chart 1

Chart 1 illustrates hiring trends in the risk, compliance and internal audit sectors in NYC 2023 vs 2024 (ytd). During 2023, hiring remained consistent, peaking in January following a buoyant period of hiring through 2021 and 2022, following the COVID crisis. This dissipated soon after, with general volumes falling throughout the year most likely spurred on from the collapse of both SVB and Signature Bank in March 2023. Despite an unusual uptick in August of that year, the volumes continued to drop throughout the remainder of 2023.

By early 2024, it became apparent the continued threat associated with the ever-advancing landscape of AI and digital banking services. With heightened oversight and evolving compliance requirements, the number of GRC opportunities steadily rose, peaking in May 2024.

The events of March 2023 highlighted vulnerabilities in banks’ liquidity and interest rate risk management, prompting regulatory bodies to reassess stress testing and capital adequacy requirements. The Federal Reserve, for instance, adjusted stress testing scenarios under CCAR (Comprehensive Capital Analysis and Review) for 2024 to include more severe liquidity stresses, reflecting lessons learned from the March banking turmoil.

These incidents underscored the need for stronger oversight of banks’ asset-liability management, especially in a high-interest rate environment, leading to calls for tighter regulations and enhanced supervision of mid-sized and regional banks.

Financial services firms in NYC and beyond should continue to proactively adapt their risk management strategies to navigate this dynamic regulatory environment throughout the remainder of this year, and most certainly into 2025.

About Us

At Magnus Partners, our team of seasoned talent and human capital specialists are dedicated to bridging the gap between exceptional senior executives and leading employers.

Our recruitment ethos is deeply rooted in the principles of Diversity, Equity, and Inclusion (DEI). We believe that a diverse team drives innovation and success, and we are committed to creating an environment where every individual is valued, respected, and empowered. Our recruitment process is designed to ensure fairness and equity, providing equal opportunities for candidates from all backgrounds and experiences.

If you have any questions on the report or would like to discuss any specific recruitment needs, please contact us.